Central bank surveys of bank loan officers are a key gauge of the success of recent policy initiatives in easing credit conditions.

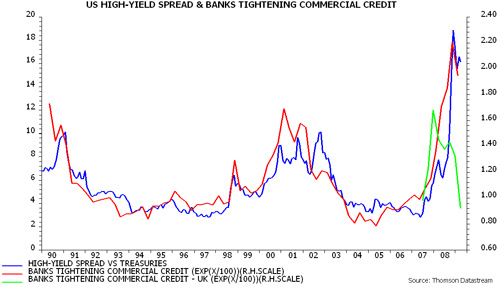

In the last US survey, conducted in January, the net percentage of banks reporting tighter credit standards on loans to firms remained close to its historic high. This indicator correlates closely with the yield spread of non-investment-grade corporate bonds over Treasuries – see first chart.

The April survey is due for release in early May. As the chart shows, however, the equivalent UK indicator from yesterday’s Bank of England credit conditions survey fell significantly between November / December and February / March. A similar drop in the US indicator would suggest better prospects for high-yield bonds.

The UK improvement may have been exaggerated by country-specific factors, such as government agreements with Lloyds Banking Group and the Royal Bank of Scotland to expand lending and the Bank of England’s purchases of corporate securities. Nevertheless, recent policy actions should contribute to at least some fall in the US indicator.

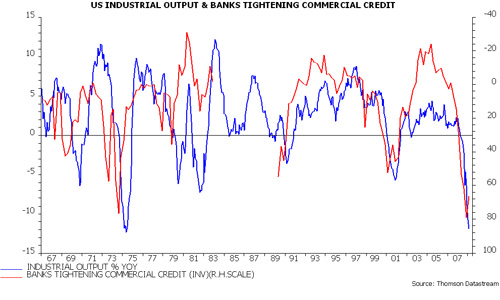

The net tightening percentage, inverted, is also a good leading indicator of the economy – see second chart – so a fall would boost recovery hopes.