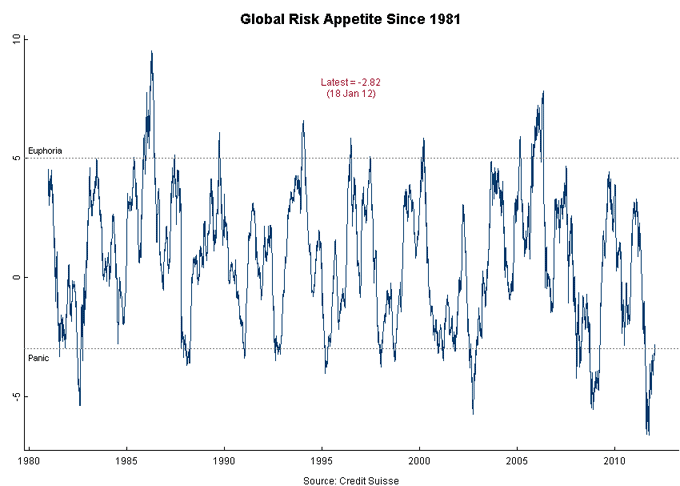

World equities are up by 14% in US dollar terms from their early October low but Credit Suisse’s global risk appetite measure has only just exited “panic” territory – see first chart. On this measure, at least, “risky” assets are not yet overbought.

The Credit Suisse measure remains depressed partly because of the continuing strength of “safe” assets like Treasuries and gilts. A shift of funds out of safe assets into equities etc often marks the final stage of risk rallies. Such a shift has yet to occur.

Treasuries and gilts, admittedly, are being artificially boosted by central bank manipulation in the form of “Operation Twist”, UK QE2 and an extension of existing commitments to maintain rock-bottom official rates.

The combination of unappealing safe government bond yields, plentiful liquidity and a revival in global economic momentum in early 2012 may allow equities to continue to grind higher despite likely further Eurozone woes and other global risks. Even in Euroland, “Maestro” Draghi’s backdoor QE / bank bail-out operation has reduced the potential for negative developments to wreak havoc in markets.

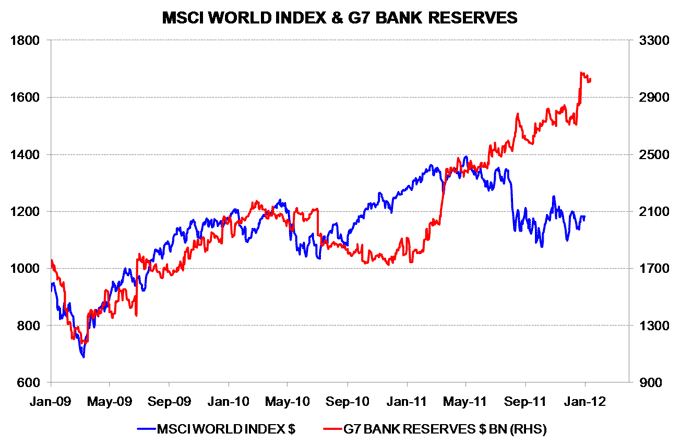

A wide gap has opened up between world equities and G7 bank reserves – second chart. There are many other drivers but the chart conveys an impression of the liquidity “cushion” under markets and the scope for further gains should investors move into full “risk-on” mode.