Liquidity thaw under way but risks remain

From a liquidity perspective, market falls since late 2007 were caused by a fear-induced rise in the precautionary demand for money coupled with a withdrawal of credit from leveraged investors, resulting in forced selling of assets. Contrary to fears, the global supply of money has continued to expand but not sufficiently to offset these negatives.

As the second quarter begins, money supply trends are improving, risk aversion and precautionary cash demand appear to be moderating and investor leverage is at its lowest level for several years. This suggests support for equity markets but any rally faces hurdles from ongoing poor earnings news, a likely rise in issuance and a possible rebound in commodity prices.

A key policy development last quarter was the $1.15 trillion expansion of the Fed’s securities purchase programme, which promises to give a major boost to US and global monetary growth. Including the unutilised portion of earlier plans, the Fed could buy $1.4 trillion of assets over the remainder of 2009, equivalent to 11% of US M2+ and about 5% of our G7 broad money measure.

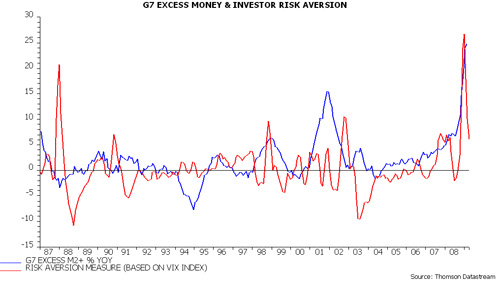

The demand for money is unobservable but cash hoarding is likely to diminish as fears of financial collapse abate and the economic cycle approaches a trough. Consistent with this view, measures of risk aversion have moderated recently – see chart – while narrow monetary aggregates have been rising relative to broader measures, which often precedes a pick-up in velocity.

Meanwhile, investor deleveraging appears to be well-advanced. US margin debt is back at 2003 levels while hedge fund returns have recently shown little correlation with equities, suggesting minimal market exposure. Hedge funds suffered investor withdrawals of $260 billion between November and January but outflows slowed to $17 billion in February, according to Trim Tabs.

While the liquidity backdrop for equities is improving, several factors could delay a significant recovery in markets. First, corporate newsflow may remain negative – another large fall in global GDP in the first quarter suggests the potential for downside surprises in coming earnings reports, even relative to recently-lowered expectations.

Secondly, any rally is likely to call forth an avalanche of issuance as companies seek to reduce gearing against the backdrop of high corporate borrowing costs. Balance sheet adjustment also implies that cash take-over activity and share buy-backs will remain weak for the foreseeable future.

Thirdly, “excess” liquidity resulting from a fall in money demand relative to supply could flow into commodity markets, particularly given investor concerns that unprecedented monetary and fiscal stimulus will lead to higher inflation over the longer term. A renewed commodity price surge would damage prospects for a recovery in economic activity and earnings recovery later in 2009.

Reader Comments