Are Eurozone banks "hoarding" liquidity?

Media reports continue to refer to the level of balances in the ECB’s deposit facility as a gauge of liquidity “hoarding” by banks. If only it were so simple.

An increase in the ECB’s lending to banks in repo operations automatically injects liquidity into the system. Banks hold this cash either in their current accounts at the ECB or the deposit facility. Since they earn no interest on current account balances in excess of reserve requirements, it mostly ends up in the deposit facility.

Suppose that banks with more cash increase lending or buy existing securities (i.e. they don't "hoard"). The cash is transferred to other banks (those where the recipients of the lent funds or the sellers of the securities hold their accounts), whose current account / deposit facility balances therefore rise. The aggregate position falls only if the cash flows to weaker banks, who repay lending from the ECB, thereby withdrawing liquidity from the system. Otherwise, use of the deposit facility will remain high even though banks are not “hoarding”. (Liquidity can also be withdrawn by banks buying new government securities, resulting in cash being transferred from banks’ to governments’ accounts with the ECB.)

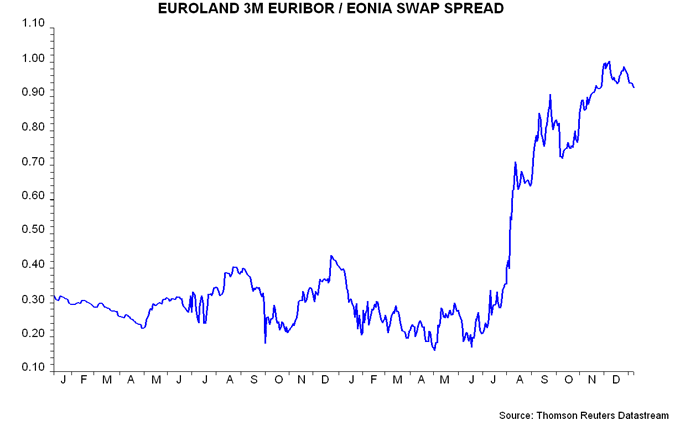

The daily deposit facility numbers, therefore, provide little information about banking system activity and risk aversion – the latter is better captured by the three-month Euribor / overnight interest rate swap spread, which yesterday fell to its lowest level since late November.

Reader Comments