Chinese money trends reflecting PBoC caution

Chinese six-month money growth rates were little changed in September / October following a sharp slowdown over the summer, suggesting weak economic prospects through end-Q1 2024. A small consolation is that recent monetary softness is partly explained by a rise in government deposits at the PBoC, representing yet-to-be-deployed fiscal firepower.

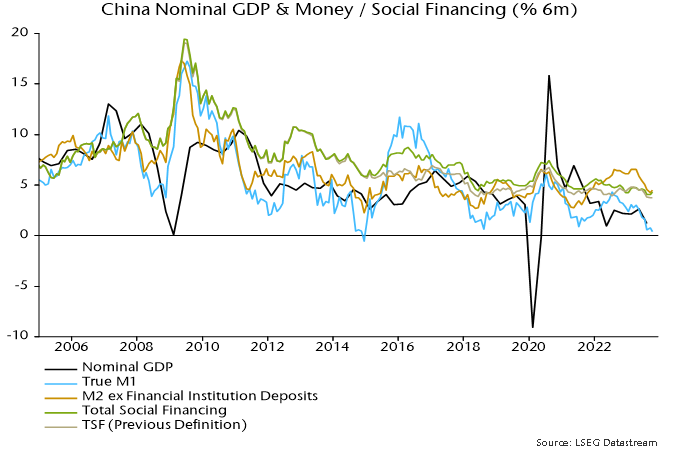

Narrow money trends are most concerning. Six-month growth of true M1 in October was the weakest since late 2014, ahead of the 2015-16 hard landing scare – see chart 1. Sectoral figures show a contraction of demand deposits of non-financial enterprises partly offset by weak but rising household deposit growth. This divergence was echoed in October activity data, with retail sales modestly better but private fixed asset investment continuing to flatline.

Chart 1

Credit growth has held up better than monetary expansion but total social financing has been supported by record issuance of local government special bonds. These were excluded from the previous TSF definition, which is a better guide to non-government credit trends and has fallen further – chart 1.

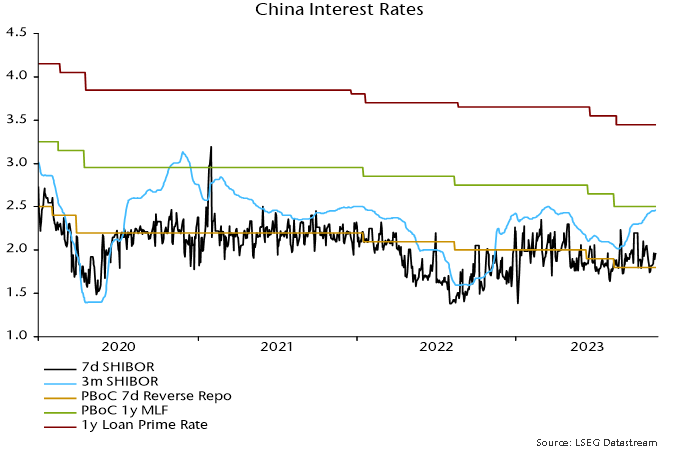

The spring / summer slowdown in money / credit reflects PBoC tightening around end-2022 and an associated sharp rise in money market rates. A reversal of this increase into August warranted a hope that money growth would recover in late 2023 but term rates have since returned to their high, though may be peaking – chart 2.

Chart 2

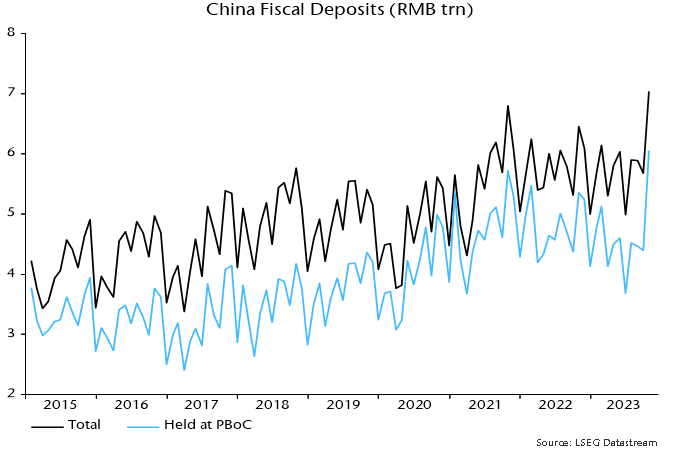

A previous post based on data through September argued that money market tightness had been partly caused by “overfunding” of the budget deficit, i.e. bond issuance to finance future spending. Excess borrowing accelerated in October, with fiscal deposits at the PBoC rising by a whopping RMB 1.7 trillion on the month – chart 3. This explains why large-scale PBoC injections have yet to bring down market rates.

Chart 3

The silver lining is that bank reserves and money growth will benefit as this fiscal firepower is deployed.

The potential boost to narrow money is modest – a fall in fiscal deposits from the current RMB 7.0 trillion to their 2022 average of RMB 5.8 trillion would, if fully reflected, add 1.2% to true M1. Additional PBoC easing measures are needed for a material improvement in monetary and economic prospects.

Reader Comments