Monetary conditions still tightening

Global six-month real narrow money momentum is estimated to have broken to a new low in August, reinforcing pessimism here about economic prospects and casting strong doubt on now widely-held “soft landing” hopes.

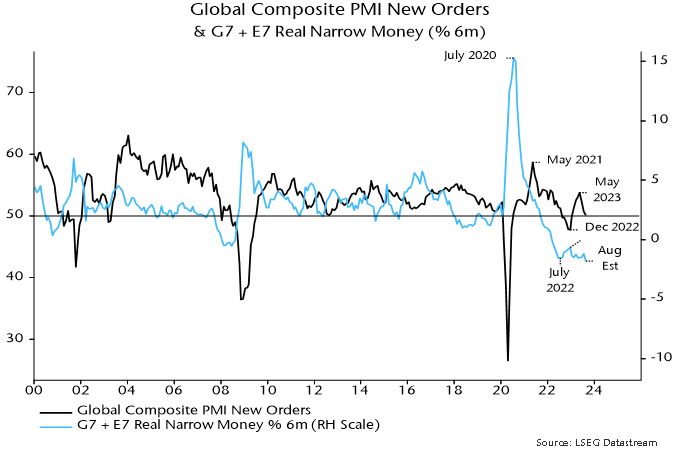

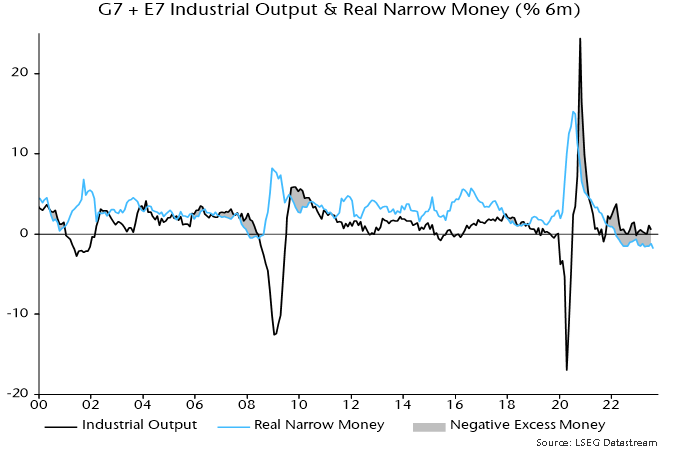

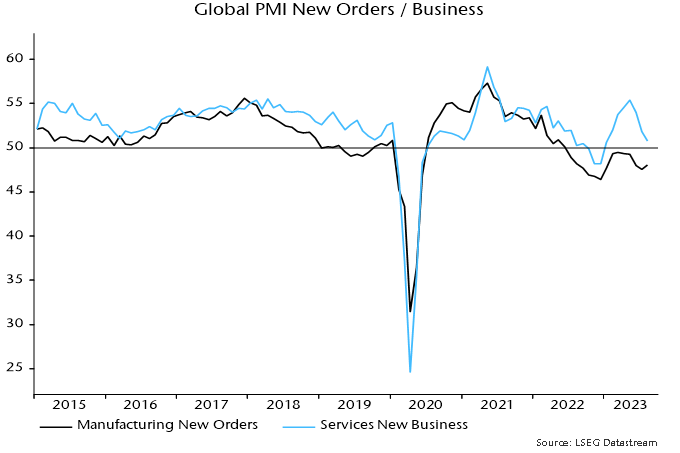

Real money momentum bottomed in July 2022, recovered during H2 but suffered a relapse in early 2023, retesting the 2022 low in April. The relapse has been reflected in a renewed downswing in economic momentum, as proxied by global composite PMI new orders – see chart 1.

Chart 1

A tentative stabilisation of real money momentum over the summer suggested that PMI new orders would bottom out around year-end. The further move down in August, if confirmed, signals deeper and more extended economic weakness.

The August estimate is based on monetary data covering 70% the global (i.e. G7 plus E7) aggregate and near-complete CPI results.

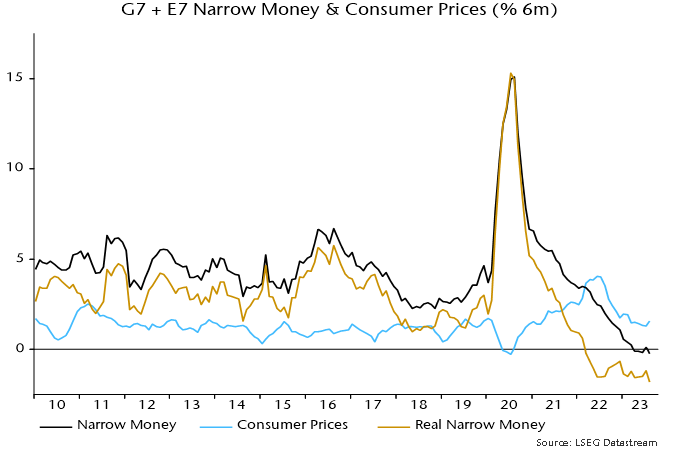

The suggested fall to a new low reflects both additional nominal money weakness and an oil-price-driven recovery in six-month CPI momentum – chart 2.

Chart 2

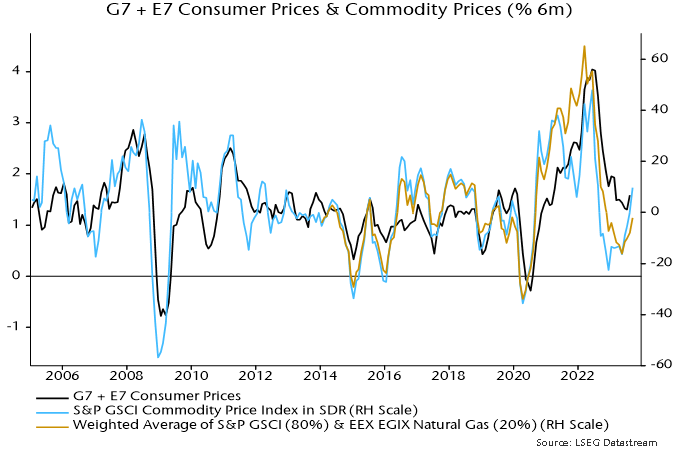

The ongoing oil price rally suggests a further near-term rise in headline CPI momentum – chart 3. A core slowdown, however, is expected to continue and may accelerate as higher oil costs squeeze spending on other items.

Chart 3

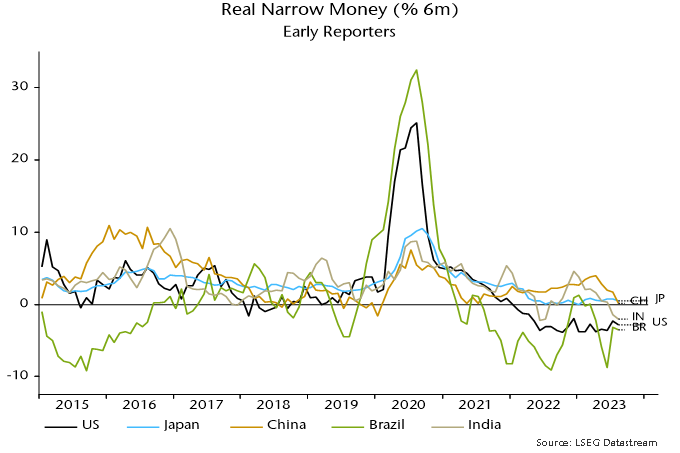

The further fall in real narrow money momentum has been driven mainly by China and India – chart 4. An earlier post attributed Chinese monetary weakness to misguided policy tightening in late 2022, which has since been partially reversed. Chinese August money numbers suggest greater damage from the misstep than previously assumed, implying a more urgent need for additional policy easing.

Chart 4

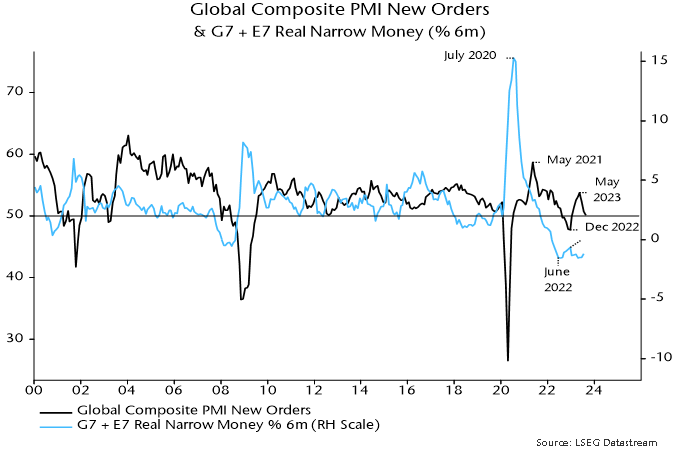

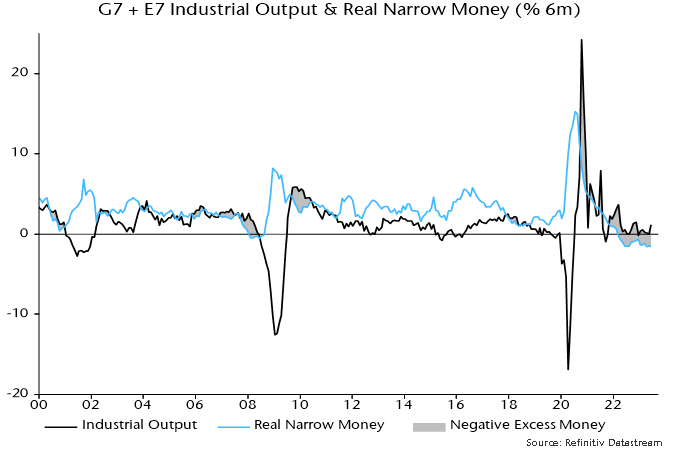

An August estimate of global industrial output is not yet available but a large negative differential between six-month rates of change of real narrow money and output is likely to have persisted – chart 5.

Chart 5

As previously noted, global equities have underperformed cash since this differential turned negative in early 2022 (allowing for reporting lags), despite a rally over the last 12 months.

Why was weakness compressed into the first nine months of 2022, with a subsequent strong rebound?

One explanation is that the Ukraine invasion and associated immediate further upward pressure on energy prices exaggerated the market response to monetary deterioration. Positioning and sentiment reached oversold extremes in late 2022, creating the potential for a relief rally as energy markets adjusted and prices fell back.

Another possibility – admittedly difficult to assess – is that the “excess” money backdrop has been less unfavourable than suggested by the six-month momentum differential shown in chart 5, because of the existence of an overhang from the 2020-21 monetary surge. An excess stock of money, in other words, may have persisted despite the flow turning negative.

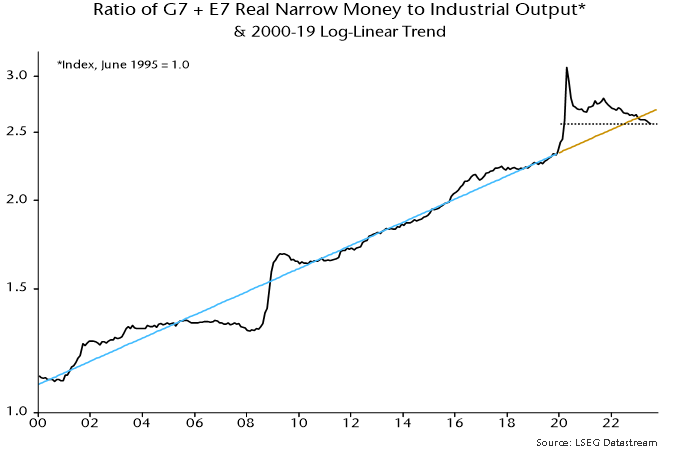

The ratio of the stock of real narrow money to industrial output has trended higher over time, with the increase reflected in rising real asset prices and wealth – chart 6.

Chart 6

A huge overshoot in 2020-21 has been correcting since late 2021 but the ratio was still above its pre-pandemic trend at end-2022, i.e. the negative flow differential had not fully offset the prior period of excess.

The stock and flow signals, however, are now aligned: the real money / output ratio moved below trend in early 2023 and its July level was the lowest since February 2020 before the policy response to the pandemic and subsequent monetary surge.

UK labour market data weak not "mixed"

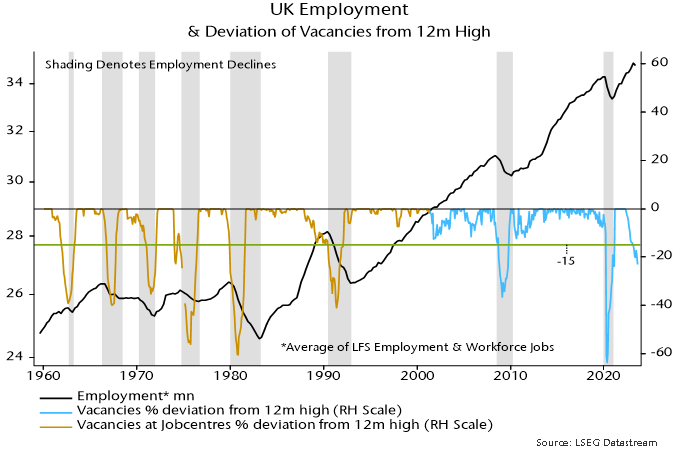

A post in May suggested that UK employment would embark on a sustained decline in Q2. This was based on the stock of vacancies having fallen 17% from its 12-month peak – declines of more than 15% historically were always associated with sustained employment falls.

Labour Force Survey employment fell by 207,000 in the three months centred on June from three months earlier, while the workforce jobs measure (of positions rather than people) was down by 153,000 between March and June.

Vacancies have continued to collapse, with the August stock down by 23% from its 12-month high and 29% below the April 2022 peak – see chart 1.

Chart 1

The three-month average unemployment rate, meanwhile, rose further to 4.3% in July versus an August 2022 low of 3.5%, confirming a Sahm rule recession signal (an increase of more than 0.5 pp from the 12-month minimum) – chart 2.

Chart 2

A July post noted that the Sahm rule has an imperfect record as an indicator of UK recessions but signals were always associated with a slowdown in average earnings growth.

Annual growth of regular earnings ticked down from 8.0% in June to 7.8% in July, while median pay growth in the more timely PAYE dataset eased to 6.7% in August – chart 3. (Caveat: the PAYE numbers are subject to significant revision.)

Chart 3

In light of the above, claims that the latest labour market news is “mixed” and shouldn’t deflect the MPC from another rate hike next week are odd and appear to reflect confirmation bias.

Money / credit contraction argues that current policy is much too restrictive. The ongoing collapse in vacancies and faster-than-expected deterioration in more lagging labour market indicators are consistent with this interpretation.

MPC member Catherine Mann argues for erring on the side of overtightening because rates can be cut swiftly if a mistake becomes apparent. If only the economic damage from bad policy-making were so easily reversed.

Global "double dip" on track

A “double dip” in the global economy suggested by monetary trends appears to be playing out, with weakness likely to intensify into late 2023.

The global composite PMI new orders index – a timely coincident indicator – continued its decline from a May peak last month. A relapse had been suggested by a fall in six-month real narrow money momentum from December 2022 – see chart 1.

Chart 1

The year-to-date low in real money momentum occurred in April but there was little recovery through July and another decline is possible. The suggestion is that the PMI will fall further into Q4 and remain weak into early 2024.

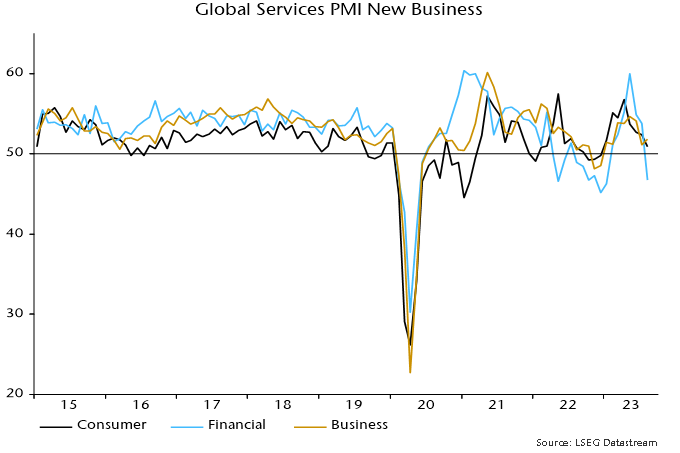

As expected, the composite PMI fall is being driven by services converging down towards weak manufacturing – chart 2. The August decline in services new business reflected a plunge in demand for financial services and a further consumer slowdown, with a partial offset from a minor recovery in business services after a larger July drop – chart 3.

Chart 2

Chart 3

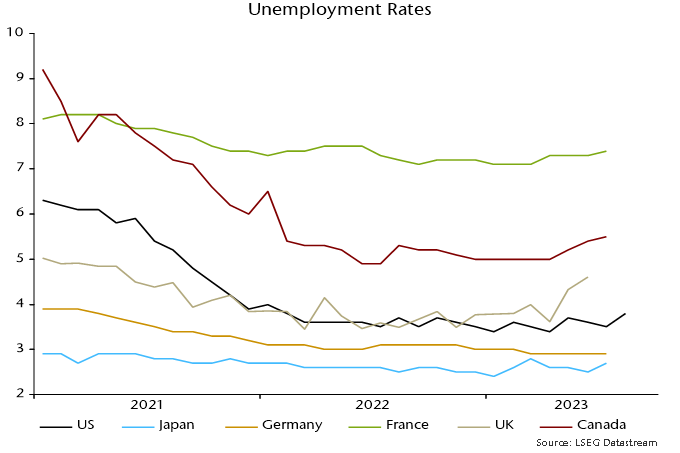

The ending of the services mini-boom, which fuelled recent employment gains, suggests a faster loosening of labour markets. Unemployment rates have reached 12+ month highs in the US, France, the UK and Canada, while a rise appears to be under way in Japan – chart 4.

Chart 4

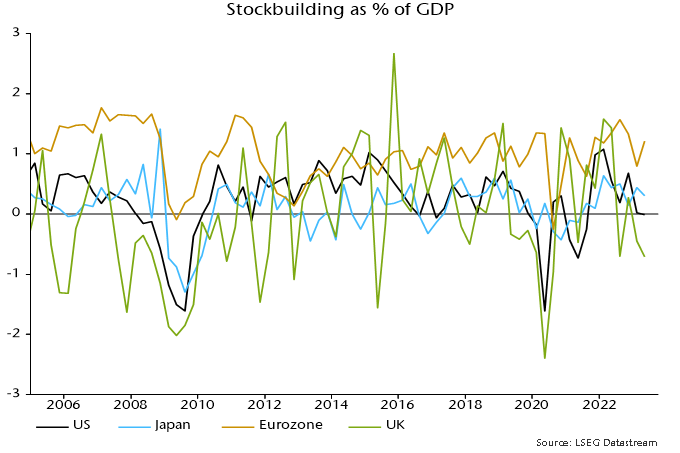

Previous posts suggested that a bottoming out of the stockbuilding cycle would support manufacturing new orders later in 2023. The cycle downswing, however, could be extended by delayed inventory cut-backs in the Eurozone: stockbuilding bounced back in Q2 as final demand contracted sharply, with recent adjustment lagging far behind the US / UK – chart 5.

Chart 5

Disastrous European monetary data

Eurozone / UK July money numbers offer further support to the assessment here that ECB / Bank of England policy tightening has been excessive and – unless reversed swiftly – will cause unnecessarily severe economic weakness and a medium-term inflation undershoot.

The latest releases are astonishing in several respects.

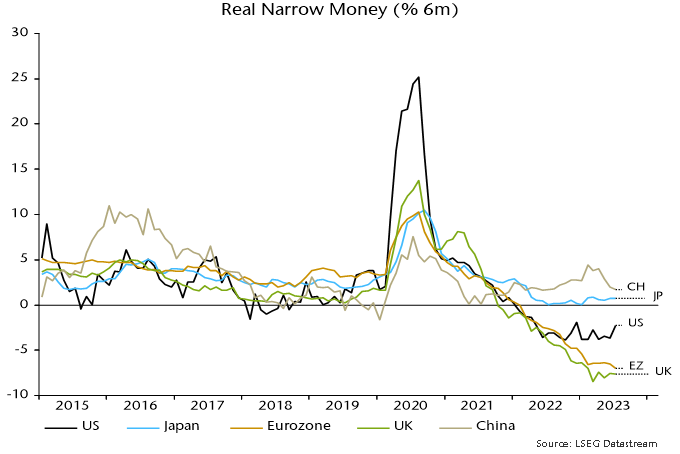

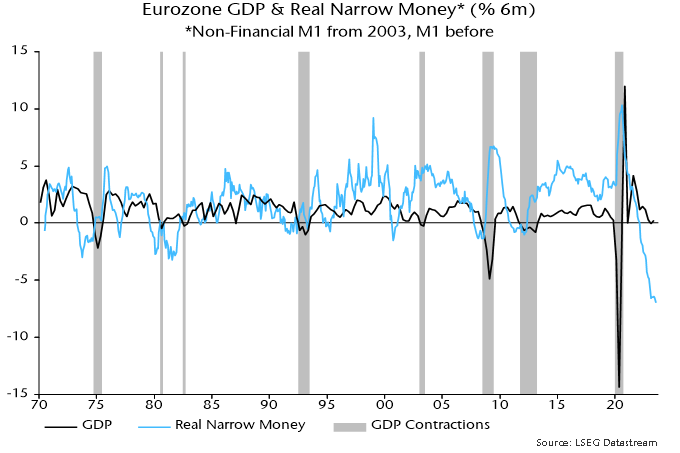

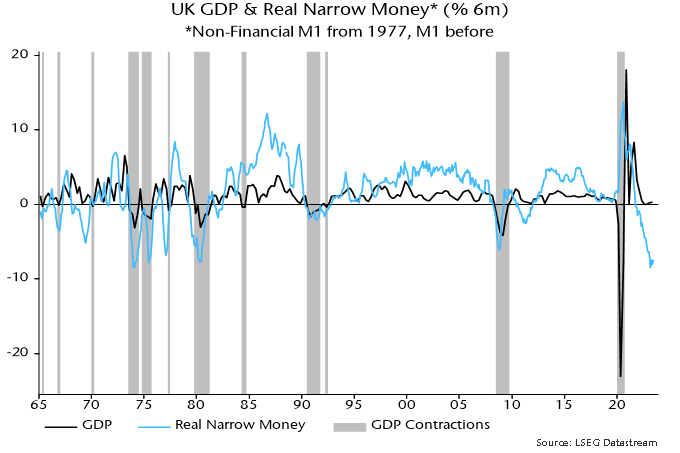

Six-month real narrow money momentum hit a new low in the Eurozone in July and is even weaker in the UK despite a recent boost from falling six-month CPI inflation. Readings are much worse than elsewhere and historically extreme – see charts 1-3.

Chart 1

Chart 2

Chart 3

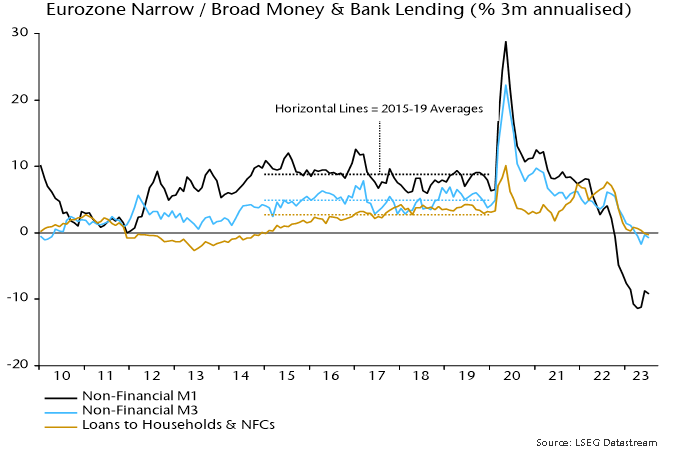

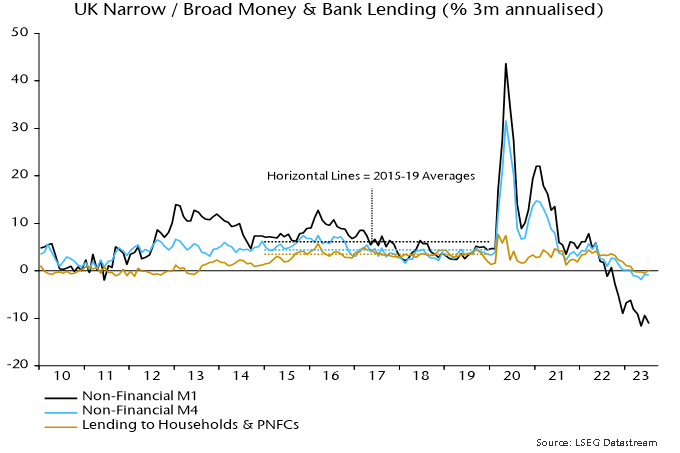

Broad money has followed narrow into nominal contraction. The preferred broad measures here, i.e. Eurozone non-financial M3 and UK non-financial M4, fell at annualised rates of 0.8% and 0.9% respectively in the three months to July – charts 4 and 5.

Chart 4

Chart 5

Broad money declines are rare: since 1970, the Eurozone / UK three-month changes were negative only for a brief period around the GFC, with the falls of similar magnitude to recently.

Money leads the economy while credit is coincident / lagging. Bank lending to households and non-financial firms is starting to contract, consistent with recessions being under way – charts 4 and 5.

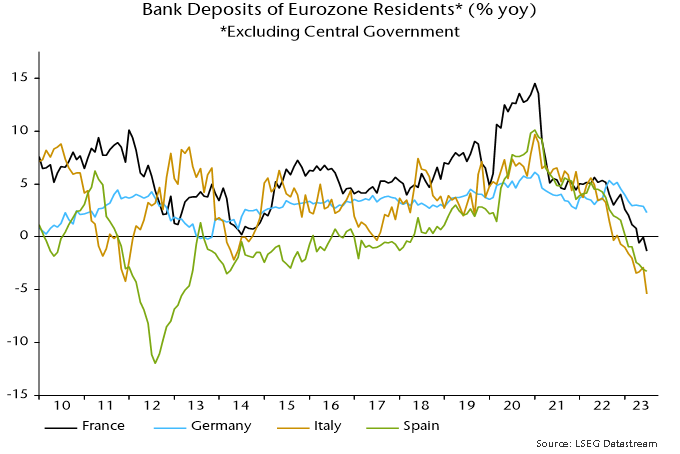

A further notable feature of the Eurozone data is a widening divergence between still-rising bank deposits in Germany and falls elsewhere – chart 6.

Chart 6

A similar core / periphery monetary divergence in 2011 warned of an escalating Eurozone crisis. The driver then was capital flight from the periphery, reflected in a ballooning of national central bank TARGET deficits / surpluses.

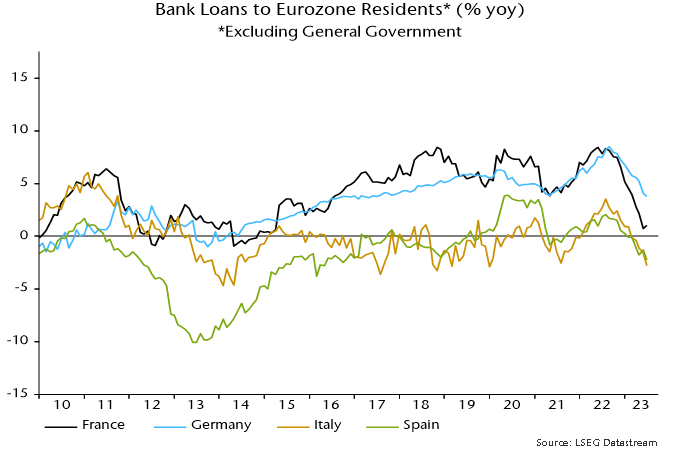

The Bundesbank’s TARGET surplus has fallen recently. Rather than capital flows, the relative resilience of German broad money is explained by less pronounced weakness in bank lending – chart 7.

Chart 7

So money / credit trends suggest that economic prospects in the rest of the Eurozone are at least as bad as in Germany.

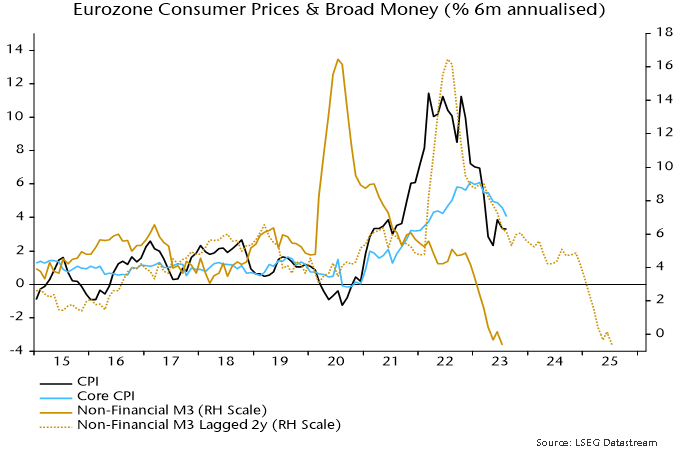

Eurozone six-month CPI momentum, meanwhile, continues to track a simplistic monetarist forecast based on the profile of broad money growth two years earlier – chart 8. Six-month headline momentum was unchanged at 3.3% annualised in August but core slowed further to 4.0%, a 17-month low.

Chart 8

The suggestion is that six-month headline momentum will reach 2% next spring, with the annual rate following during H2. A subsequent significant undershoot is indicated unless recent monetary weakness is reversed.

Why have real yields risen?

Why have global government bond yields picked up over the summer despite weakening PMIs and neutral / favourable inflation news?

The rise is attributed here to a further deterioration in the global “excess” money backdrop driven partly by unexpected output strength as an easing of supply constraints has allowed firms to work off order backlogs. Output is expected to realign with weak / falling incoming demand during H2, suggesting a reversal of liquidity tightening.

The rise in nominal yields has been driven by the real component with inflation expectations little changed.

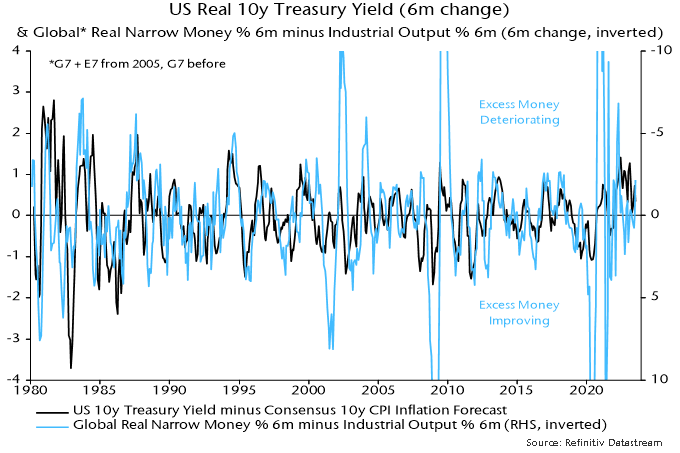

Changes in real yields have been inversely correlated historically with changes in global “excess” money momentum, as measured by the differential between six-month rates of change of real narrow money and industrial output – see chart 1.

Chart 1

This differential has been negative since early 2022 but was expected to narrow as monetary tightening fed through to weaker economic activity and slowing inflation lifted real money momentum. Instead, industrial output growth rose to a seven-month high in June while nominal money weakness has offset a disinflation boost to real momentum – see chart 2.

Chart 2

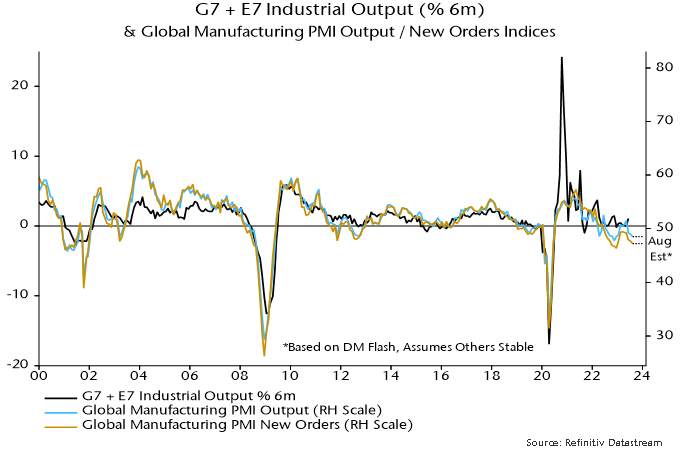

Production resilience was signalled by a recovery in the global manufacturing PMI output index, which crossed 50 in February on the way to a May high. It moved back below breakeven in June / July, however, with August flash results suggesting a return to the December 2022 level or lower – see chart 3.

Chart 3

Covid-related supply disruption resulted in the PMI output index lagging the new orders index in 2021 / H1 2022, but the position has reversed over the past year as production bottlenecks have eased, allowing firms to fulfil outstanding orders.

With the PMI delivery speed index – an inverse indicator of bottlenecks – hitting a 14-year high in May, the supply catch-up is probably ending, suggesting that the PMI output index – and hard production data – will converge with weaker new orders. At the current level of the latter index, this would imply output contraction.

The real narrow money / industrial output momentum differential, therefore, is likely to narrow unless nominal money data weaken further and / or consumer price inflation rebounds (unlikely). While G7 tightening is still feeding through, stable / easier monetary policies are expected to promote money growth recoveries in EM.

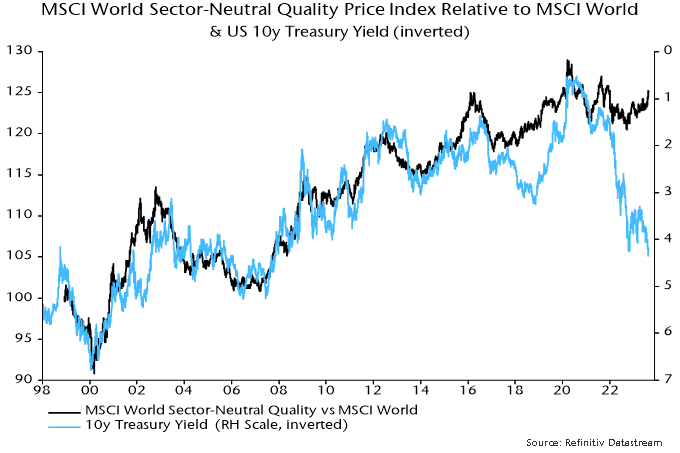

Commentaries here have suggested that the monetary / economic backdrop would favour quality stocks in 2023. The MSCI World quality index is 7.1% ahead of MSCI World in price terms year-to-date (as of yesterday’s close). This mainly reflects a high weighting in tech, but the sector-neutral quality index (which imposes MSCI World sector weights) is also now outperforming the main index and has reversed its relative weakness in 2022 – see chart 4.

Chart 4

The recent relative gain is striking against the backdrop of rising Treasury yields, with which the style has been inversely correlated historically, as the chart shows. The divergence is reminiscent of 2018, when the quality relative embarked on a sustained rise in February but a fall in Treasury yields was delayed until November. This year’s quality rally also started in February, suggesting a resolution of the current disconnect with yields by year-end.